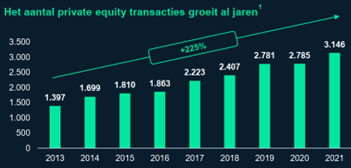

The volume of private equity investments has been growing for years [1]. Because of the high and stable expected returns, investors are allocating an increasing proportion of their investment portfolios to private equity. By adding private equity, the risk profile of the complete investment portfolio will improve because the invested capital is better distributed.

But what factors determine these stable and high returns? Why has private equity been outperforming the stock market by an average 15% for more than 20 years? Several factors are involved:

- Private equity portfolio companies get more room to focus on their medium to long-term strategy because the point of private equity funds is to invest with a long-term horizon. This provides room to implement significant strategic and operational changes. Because of this, value creation is less driven by sentiment when compared to the stock market, where listed companies are often more focused on the next quarterly figures.

- Very strict selection of private companies in attractive markets. Before a private equity fund invests, an extensive market analysis, selection and due diligence process take place. Often, hundreds of companies are screened, to invest in only 2 or 3 companies per year.

- Active share ownership. Private equity firms work together with the management of portfolio companies they invest in, based on active share ownership, to create long-term value. After investing, these fund managers actively deploy their capital, network, knowledge and entrepreneurial experience to help the portfolio company grow.

- Deeper market with significantly more private versus listed medium-sized companies. There is simply more choice.

Growing Appeal of Private Equity

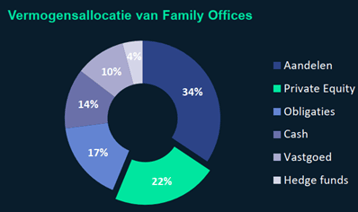

Besides attractive returns, flexibility and improvements in the risk profile also play a part in the growth of private equity as an investment class. Not only institutional investors, but family offices are also increasingly active in private equity and invest an average of 22% of their capital available for investment in this category [2]. Portfolio diversification and distribution across different assets are important in order to be less dependent on market fluctuations.

Tradability

An often-heard disadvantage of investing in private equity funds, compared to the stock market, is the tradability. Contrary to listed shares and bonds, investments in private equity are not easily traded on the open market. That is why it is important to achieve a good distribution across different investment categories. In addition, returns vary considerably from one private equity fund to another. Returns heavily depend on the quality of the fund manager. Not only diversification, but also thorough research into funds contributes to high returns.

[1] Statista Research. Europese Private Equity market.

[2] UBS Global Family Office Report 2022