Summary

Summary

Private equity

More information

Do you have any questions about this article or want to know more about Marktlink Capital? Don’t hesitate to reach out by filling in the contact form.

Published on 16 apr 2024

Private equity has experienced strong growth in the past decades, with a record amount of capital raised and, on average, high returns. Meanwhile, the current economic climate has become a lot more uncertain and there is even talk of a recession. For many investors, an entirely justified question arises: how do private equity funds perform in times of economic crisis?

Private equity outperforms the stock market

In the past few years, this question has come up frequently in various studies drawing comparisons with the stock market. Since its great rise in the 1980s, the sector has faced a number of crises, and several things stand out:

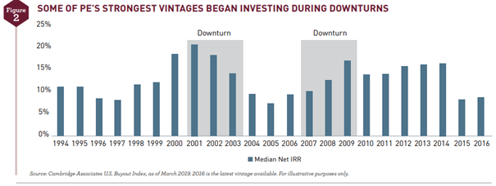

- During previous crises, private equity as an investment class has historically outperformed the stock markets. In the period from 2000 to 2016, it achieved a higher annual average of 4.4%, compared to the stock market and this contrast will only increase in times of an economic downturn. Indeed, several data providers show that the best returns are achieved by vintage1 funds from the year following the Dotcom crash (2001) and the financial crisis (2008-2009).

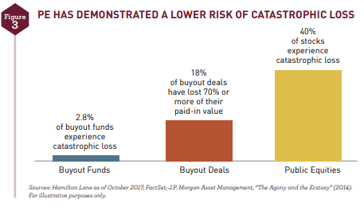

- Private equity investments are less sensitive to value fluctuations and have lower volatility during a crisis. Research by Hamilton Lane and J.P. Morgan compares the losses in private equity to the Russel 3000 index during the period 1980 to 2014. This showed that 40% of publicly registered shares in the United States experienced a catastrophic loss of >70% compared to the peak value. By comparison, less than three in a hundred private equity funds suffered similar losses during this same period, as illustrated by the graph above.

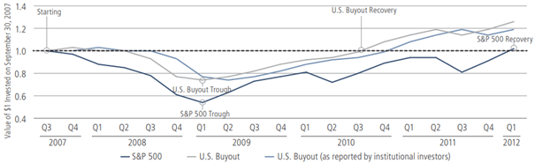

- Recent research by Neuberger Berman shows that private equity investments recover from a financial crisis quicker, which the graph below shows in detail.

What are the reasons why private equity endures recessions relatively well?

- Active management and hands-on approach: PE funds are known to be actively involved in the management of their underlying portfolio companies. In particular, established private equity funds have teams dedicated to value creation. For example, portfolio companies are helped to improve their operational processes, provided with strategic advice or helped to renegotiate loans during economic decline. Research by McKinsey has shown that funds, that specifically focus on active management, have performed relatively well in the latest economic crisis. Private equity funds that are closely involved with their portfolio companies succeed in making these resilient to economic downturns.

- Better access to capital and a higher degree of flexibility: Research shows that private equity portfolio companies have better access to capital and that PE funds maintain a higher degree of flexibility regarding the allocation of financial resources to their portfolio companies. In many cases, this is a decisive factor. For instance, the probability of a catastrophic loss (>70% decline measured from peak value) is twice as low for a company backed by a PE fund, compared to a listed company. In addition, PE companies were better able to increase their growth investments during the financial crisis (2007-2008). Access to cash and flexibility have proved crucial to surviving an economic crisis.

- Liquidity and a long-term perspective during an economic crisis: Liquid investments are characterised by the fact that they are less easily sold and exchanged for cash. Compared to other investments, private equity investments are by nature not tradeable. Investments in a PE fund are long-term investments, as a stake cannot simply be resold. This is in contrast with listed shares or funds that are traded daily on a publicly accessible market. This disadvantage is turned into an advantage during an economic crisis, because investors are less likely to sell their shares in a moment of panic. Such a sale generally leads to an even bigger loss. It forces investors to apply a long-term perspective and it protects them from making short-term decisions in the daily volatility.